DMO reopens, auctions four FGN bonds valued at N360 billion in March offer

The Debt Management Office (DMO) has offered four Federal Government of Nigeria (FGN) bonds valued at N360 billion for subscription through auction.

According to the DMO, the first offer is a February 2028 FGN bond valued at N90 billion (10-year reopening) at an interest rate of 13.98 per cent per annum.

The second offer is the April 2032 FGN bond valued at N90 billion (15-year reopening) at an interest rate of 12.50 per cent per annum.

There is also the April 2037 FGN bond valued at N90 billion (20-year reopening) at the rate.16.2499 per cent per annum.

The fourth offer is the April 2049 FGN Bond valued at N90 billion (30-year reopening) at an interest rate of 14.80 per cent per annum.

According to the DMO, the bonds are offered at N1,000 per unit with a minimum subscription of N50 million and in multiples of N1,000 after that.

“For reopenings of previously issued bonds, successful bidders will pay the price corresponding to the yield-to-maturity bid that clears the volume being auctioned plus any accrued interest on the instrument.

“Interest payment is done semi-annually while the bullet repayment (principal sum) is done on the maturity date,” the DMO said.

It said the bonds were backed by the full faith and credit of the federal government and were charged upon the general assets of Nigeria.

“They qualify as securities in which trustees can invest under the Trustee Investment Act.

“They qualify as government securities within the meaning of the Company Income Tax Act (CITA) and Personal Income Tax Act (PITA) for tax exemption for pension funds amongst other investors.

“They are listed on the Nigerian Stock Exchange Limited and FMDQ OTC Securities Exchange.

“All FGN Bonds qualify as a liquid asset for liquidity ratio calculation for banks,” it said.

(NAN)

We have recently deactivated our website's comment provider in favour of other channels of distribution and commentary. We encourage you to join the conversation on our stories via our Facebook, Twitter and other social media pages.

More from Peoples Gazette

Politics

Katsina youths pledge to deliver over 2 million votes to Atiku

“Katsina State is Atiku’s political base because it is his second home.”

Heading 4

ECWA commends CBN over stability, appreciation of naira

The church called for the sustenance of the efforts to help curb inflation.

NationWide

Tinubu appoints new boards for NAICOM, SEC

The president urged policyholders, the public interest and improving trust and confidence in the sector.

States

Gunmen killed 13 in Plateau attack: Police

“He has also been briefed on the previous security arrangement.”

Agriculture

Katsina farmers urge govts to provide fertilisers at subsidised rates

Aliyu Muhammad, a farmer, said that most farmers could not afford the commodity due to exorbitant prices.

NationWide

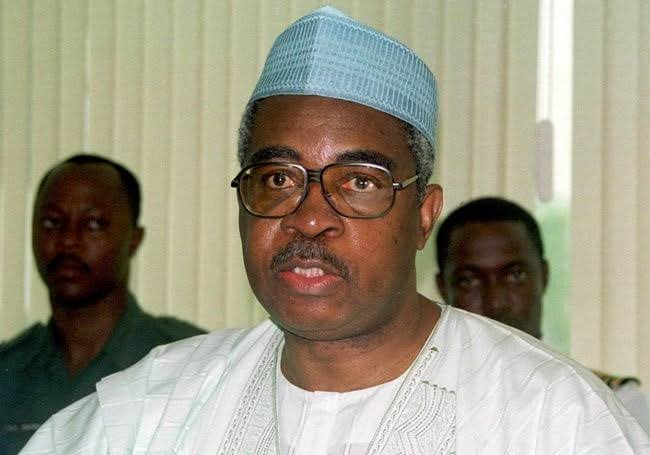

TY Danjuma begs Nigerians to stop killing each other

“There must be peace in Taraba and Nigeria for any meaningful development to take place.”

States

Osun: Police arrest four suspects for allegedly killing woman for money ritual

Ms Opalola said the suspect’s confession led to the arrest of the three other suspects.