CBN Licence Revocation: NDIC liquidates 500 deposit money, microfinance banks

The Nigeria Deposit Insurance Corporation (NDIC) says it has liquidated at least 500 deposit money, microfinance, and primary mortgage banks whose licences were revoked by the Central Bank of Nigeria (CBN).

The corporation also disclosed that it was currently settling the liquidation dividends of depositors of the banks.

Galadima Gana, the Director, Insurance and Surveillance Department of the NDIC, revealed this at the 2021 Financial Correspondents Association of Nigeria (FICAN) workshop on Friday in Ibadan.

According to Mr Gana, the corporation had closed 325 MFBs, 50 PMBs, and 49 DMBs whose licences were revoked by the CBN with minimal effects on the stability and confidence in the banking sector.

Mr Gana also mentioned that NDIC had cumulatively paid N8.27 billion to insured depositors of DMBs, N3.38 billion to insured depositors of MFBs, and N11 billion to insured depositors of PMBs.

He stated that the payment to uninsured depositors, creditors, and shareholders of DMBs cumulatively stood at N100.85 billion, N1.27 billion, and N4.83 billion, respectively.

He said this represented 51.07 per cent, 73.13 per cent and 92.81 per cent of the respective amounts.

The Managing Director of the NDIC, Bello Hassan, explained on the sidelines of the event that the corporation was settling the liquidation dividends of depositors of the banks.

”One of our mandates is also to liquidate licence deposit institutions whose deposit has been revoked by the CBN. So you have various categories that are currently in liquidation, the Deposit Money Banks (DMBs), Micro Finance Banks (MFBs), and Primary Mortgage Banks (PMBs),” Mr Hassan explained. “As liquidator, what we do immediately there is (a) revocation of licence is to pay the maximum insured amount.”

After that, he stated the corporation “proceeded to recover the loans and advances” granted by the liquidated institutions before revocation and “also realise the assets” left behind “so that we can pay it to the depositors.”

Mr Hassan added, “We only pay the maximum insured amount at the point of liquidation then, subsequently, begin to pay depositors and after that, we wind up, but the payment is currently ongoing.”

(NAN)

We have recently deactivated our website's comment provider in favour of other channels of distribution and commentary. We encourage you to join the conversation on our stories via our Facebook, Twitter and other social media pages.

More from Peoples Gazette

Politics

Katsina youths pledge to deliver over 2 million votes to Atiku

“Katsina State is Atiku’s political base because it is his second home.”

States

Kogi governor seeks FG’s help to tackle insecurity, flooding

Mr Ododo said the menace of insecurity and flooding in Kogi could impact other states bordering it if left unaddressed.

Showbiz

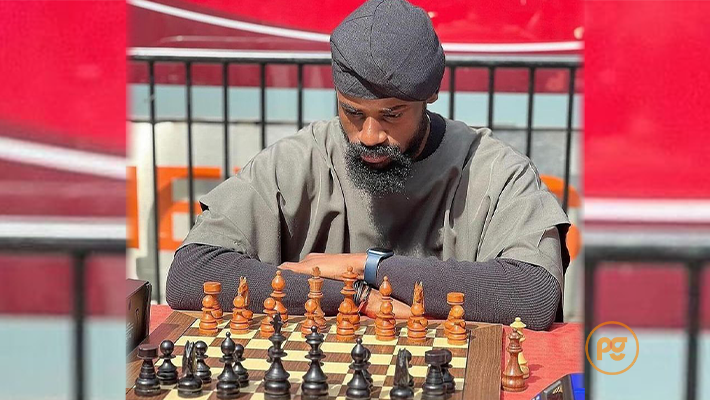

Tinubu hails feat of Nigerian chess master, Tunde Onakoya

The President assured citizens that his administration remained committed to creating and expanding opportunities for the youth.

Politics

Ondo APC accredited voters flee as violence rocks Okitipupa ward

The accredited members scampered for safety as violence broke out.

Lagos

Lagos moves against illegal estate developers in Epe

Mr Olumide said such investors may also risk losing their property or investment to demolition.

States

Ondo APC Primary: Large turnout, security at voting centres in Okitipupa

Mr Ebisanmi said that APC members were ready for the exercise.

Education

Ambassador underscores need for books promoting Nigeria’s interest

“They are books that every politician should have in his or her library.’’