FIRS amendment bill scales second reading in Senate

A bill seeking to amend the Federal Inland Revenue Service (FIRS) (establishment) Act, 2022, on Tuesday, scaled second reading at the Senate.

This followed the presentation of the lead debate on the bill’s general principles by the sponsor, Yahaya Abdullahi (PDP-Kebbi North), during the plenary.

Presenting the debate, Mr Abdullahi said the bill sought to amend the FIRS (Establishment) Act, No, 13, 2007.

He said the key objective of the amendment bill was to ensure a regulated and more organised process of granting corporate tax holidays and import duty waivers to investors and businesses in the country.

Mr Abdullahi said the bill became necessary for two related reasons: drastic shortfalls in government revenues and consequent rise in deficit spending and high debt profile.

“Hence the need to block leakages and loopholes in tax collection and due remittances to the government.

“The other reason was the mounting financial demands to fund equally increasing government public expenditures, particularly our national budgets on public infrastructure, security and welfare commitments.

“It is important for parliament to be aware of the dire predicament of our economic circumstances today and the danger we face if we fail to reign in the twin threats of deficit spending and high indebtedness.

“On the surface, it is easy to say that Nigeria is in the safe territory because our public debt of 23.6 per cent of the GDP is still within our 40 per cent threshold and the 55 per cent estimated by the IMF for economies of our size.

“The devil in our case is that debts are serviced with revenues government derives from its GDP, which in our case is abysmally low (about 6-7 per cent of the GDP),” he said.

He said it had been widely reported that about N6 trillion in expected revenue was unavailable because of tax and import duty waivers.

“This clearly indicates the spectre of the difficult times ahead.”

In his remarks, Senate President Ahmad Lawan said some waivers were unnecessary.

“Why should we give waivers in trillions and then borrow money from somewhere? It doesn’t make sense,” he said.

Mr Lawan thereafter referred the bill to the Senate Committee on Finance for further legislative actions to report back in four weeks.

(NAN)

We have recently deactivated our website's comment provider in favour of other channels of distribution and commentary. We encourage you to join the conversation on our stories via our Facebook, Twitter and other social media pages.

More from Peoples Gazette

Politics

Katsina youths pledge to deliver over 2 million votes to Atiku

“Katsina State is Atiku’s political base because it is his second home.”

Sport

Police arrest Premier League players for rape

They were arrested in front of their club’s stadium over the weekend but have since been released on bail after being interviewed by the police.

States

Court remands man for allegedly defiling a minor

The judge directed the prosecutor to forward the case file to the state DPP for legal advice.

Heading 2

Human Rights Watch urges UK to cancel ‘cruel’ deportation agreement with Rwanda

“The fight is not over,” said the rights organisation. “Legal challenges are expected against individual removals and the law itself.”

States

Man in court for allegedly stealing generator

The defendant pleaded not guilty to the charge.

World

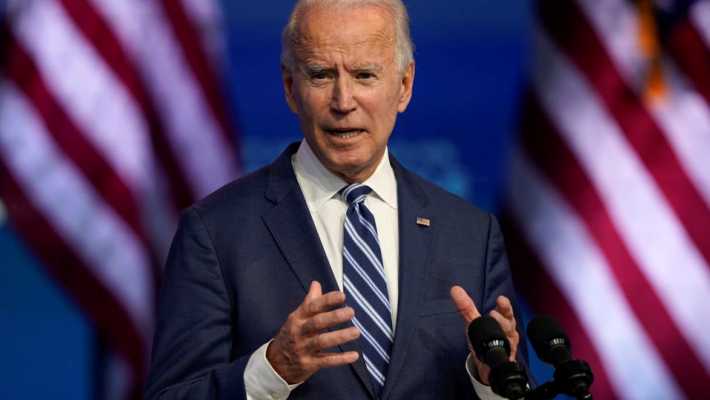

Biden says U.S. will begin sending weapons to Ukraine

“We stand resolutely for democracy and freedom, and against tyranny and oppression.’’

Africa

Nigeria, other African nations’ debt servicing rise from $17 billion to $74 billion

The African Development Bank said the continent’s $824 billion debt burden and opaque resource-backed loans hindered its potential.