July Allocation: FG, states, LGs share N760.7 billion

The Federation Accounts Allocation Committee (FAAC) has shared N760.717 billion among the three tiers of government as federation allocation for the month of July.

This is contained in a statement by Oshundun Olajide, Deputy Director (Information), Ministry of Finance, Budget and National Planning on Friday.

The statement noted that the meeting was held virtually.

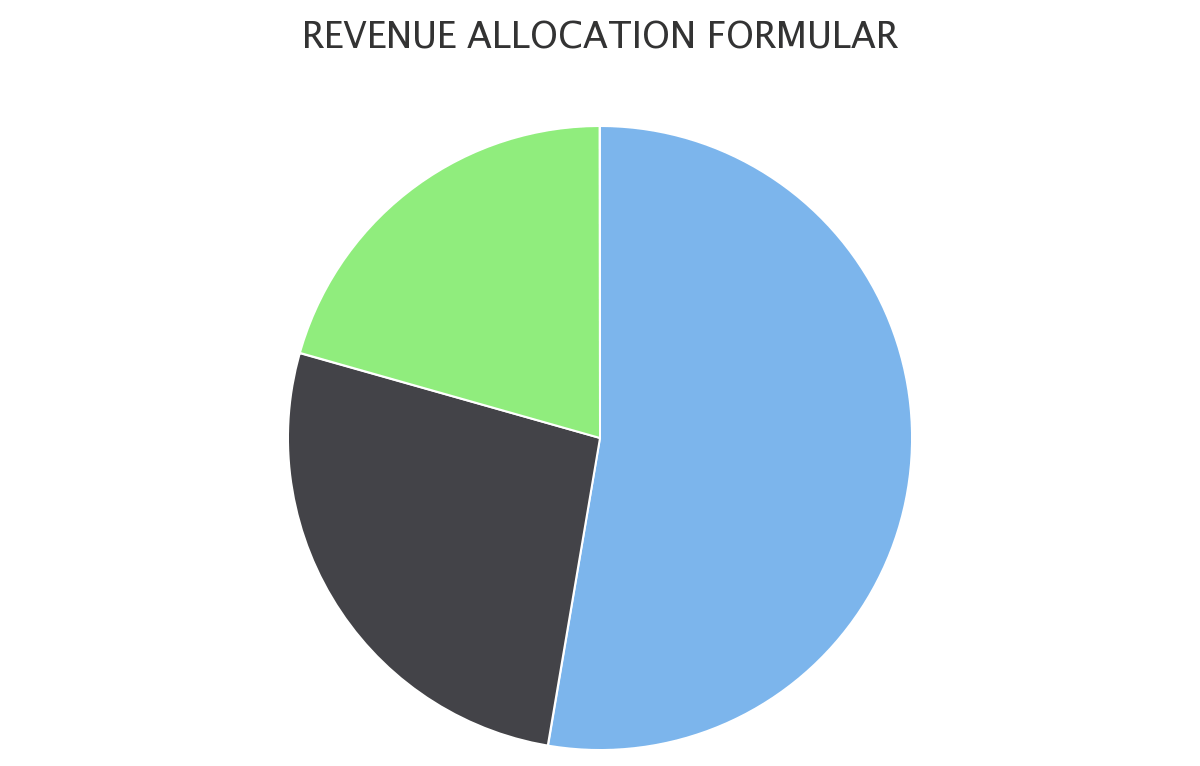

He said that out of the N760.717 billion shared, the federal government received N325.988 billion, the states received N224.929 billion while the local government councils got N168.424 billion.

“The total amount shared was inclusive of Value Added Tax (VAT) and Exchange Gain.

Meanwhile, the oil producing states received N41.376 billion as derivation (13 per cent of Mineral Revenue).

The communique issued by the committee indicated that the Gross Revenue available from the VAT for July was N151.134 billion as against N154.465 billion distributed in June.

This resulted in a decrease of N3.331 billion.

“The distribution is as follows; federal government got N21.083 billion, the States received N70.278 billion, Local Government Councils got N49.194 billion, Allocation To NEDC received N4.534 billion and Cost of collection/transfers/ refunds got N6.045 billion.

“The distributed Statutory Revenue of N601.095 billion received for the month was lower than the N812.409 billion received for the previous month by N211.314 billion, from which the Federal government received N303.765 billon, States got N154.074 billion, LGCs got N6118.785 billion, and Derivation (13 per cent Mineral Revenue) got N41.081 billion.”

The communique also revealed that Companies Income Tax (CIT), Petroleum Profit Tax (PPT), and Oil and Gas Royalties recorded significant decreases, while Import and Excise Duty, VAT decreased marginally.

It, however, disclosed that total revenue distributable for the current month inclusive of Gross Statutory Revenue of N617.705 billion, VAT of N140.555 billion, and Exchange Gain of N2.457 billion, bringing the total distributable revenue to N760.717 billion.

(NAN)

We have recently deactivated our website's comment provider in favour of other channels of distribution and commentary. We encourage you to join the conversation on our stories via our Facebook, Twitter and other social media pages.

More from Peoples Gazette

Politics

Katsina youths pledge to deliver over 2 million votes to Atiku

“Katsina State is Atiku’s political base because it is his second home.”

Africa

ECOWAS allocates $25 million to fight terrorism in Nigeria, Mali, others

“Out of a fund of $25 million intended for the fight against terrorism in Nigeria, Burkina, Mali and Niger, ECOWAS has reserved $4 million for humanitarian actions,

States

Kwara targets 1.5 million children for polio vaccination

The executive secretary also added that the Wild poliovirus type 2 was eradicated in 1999, and Wild poliovirus type 3 was eradicated in 2020.

World

Turkish president urges Western countries to respond to Israel’s killings of Palestinians

The Turkish president said an immediate and lasting ceasefire must be achieved as soon as possible in the conflict between Israel and the Palestinians.

World

Blinken backs Israel’s security, says tensions must be defused

Mr Blinken did not confirm an alleged attack by Israel on Iran overnight and said only that the U.S. was not involved in any offensive operations.

States

Police arraign 37-year-old man over illegal possession of pistol

Mr Ibrahim alleged that the defendant unlawfully possessed the pistol, which he could not give a satisfactory account of.

World

EU sanctions Israeli settlers over violence in West Bank

Those subject to sanctions would no longer be allowed to enter the EU or do business with EU citizens.