Nigeria loses N100 billion annually to tax related corruption, says anti-graft group

The Human and Environmental Development Agenda (HEDA) has said Nigeria loses in excess of N100 billion yearly to tax-related corruption.

The anti-graft organisation, in a statement made available to Peoples Gazette on Monday, said the Economic and Financial Crimes Commission (EFCC), Code of Conduct Bureau (CCB) and other stakeholders at an anti-corruption situation room on Saturday highlighted tax manipulation and evasion as one of the most devastating sources of corruption in Nigeria.

In a communiqué issued after the event, stakeholders said many actors in the information technology sector and multinational companies were in the habit of evading taxes, asking the federal authorities to enforce an effective tax system.

“Corruption cannot be fought effectively unless Nigeria deals with tax fraud. Many individuals and corporate organisations evade or manipulate tax. They do this in collaboration with professionals like accountants and lawyers.

“Tax remains the only steady source of income. Unless there is a transparent tax regime, more than N100 billion will be lost by Nigerians every year to tax related fraud,” the communiqué read.

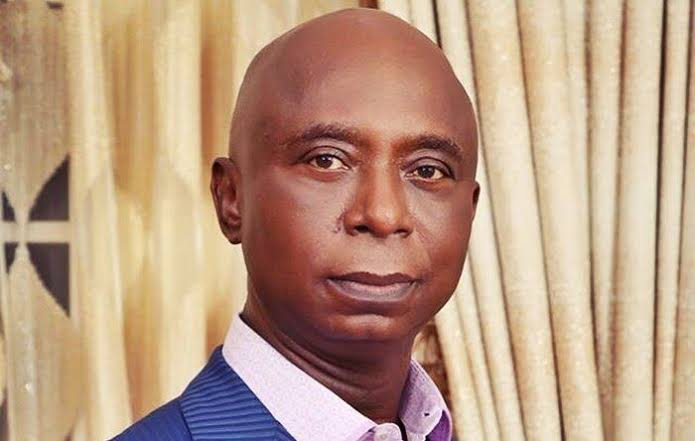

On his part, HEDA Chairman, Olanrewaju Suraju, termed corruption a teething problem that has resulted in poverty, lack of jobs and growing wave of violence and extremism, asking Nigerians to work in unity to tackle corruption headlong.

The Independent Corrupt Practices and Other Related Offences Commission in April uncovered about 2,000 corporate entities involved in tax evasion while operating in Nigeria.

In May, the Federal Inland Revenue Service (FIRS) disclosed its intention to start deducting tax liabilities from defaulters’ bank accounts.

FIRS’ move to deduct tax liabilities directly from bank accounts followed the rising debt profile of companies, corporations, ministries, departments, and agencies.

Abdullahi Ahmad, FIRS’ spokesperson, said the tax agency considered drastic measures to recover taxes and prosecute defaulters for wilful negligence, tax evasion, and unlawful conversion of government property.

He said the agency was working in line with Section 31 of the Federal Inland Revenue Service (Establishment) Act, 2007 (as amended), to recover owed taxes from defaulters.

We have recently deactivated our website's comment provider in favour of other channels of distribution and commentary. We encourage you to join the conversation on our stories via our Facebook, Twitter and other social media pages.

More from Peoples Gazette

Politics

Katsina youths pledge to deliver over 2 million votes to Atiku

“Katsina State is Atiku’s political base because it is his second home.”

States

Osun government urges residents to be on lookout for water pipe vandals

The water corporation’s general manager appealed to the state residents to be vigilant and monitor the activities of scavengers in their areas.

NationWide

Saudi donates 50 tonnes of dates to Nigerian government

Mr Alghamdi said the humanitarian donation reflected the decades-long brotherly bond between Nigeria and Saudi Arabia.

World

Iran, China agree on closer military cooperation

China has become the main customer of Iranian oil and a significant economic partner.

States

Lagos seals three churches, five hotels for noise pollution, other environmental breaches

According to the statement, LASCOPA shut down the establishments for alleged noise pollution and violation of other environmental laws.

World

Xi Jinping meets Blinken amid China-U.S. frosty ties

President Xi Jinping of China met with the U.S. secretary of state Antony Blinken meet on Friday.

NationWide

Lawmaker seeks establishment of rehabilitation, integration agency for talented offenders

Senator Ned Nwoko (PDP-Delta) says he has proposed a bill before the Senate to establish a National Talent Rehabilitation and Integration Agency.