SPECIAL: How Nigerian small business owners were shut out of CBN’s multibillion-naira COVID-19 intervention disbursements

Four years into his fashion business, young entrepreneur Divine Nwoye had just bought a four-pin machine in February 2020 to improve his shirt branding business when the COVID-19 pandemic struck.

Mr Nwoye, 26, told Peoples Gazette he had only recently employed eight people to assist him in production before the global pandemic.

“When the pandemic came, I was unable to use the four-pin machine that I bought in February 2020 for N150,000,” Mr Nwoye lamented, adding that the cost of materials all went up.

Like any other small business owner, he was shocked at the emergence of COVID-19 and unable to pay his workers, who were earning between N8,000 and N25,000.

To survive the pandemic and keep food on the table, he had to close his business to look for a salaried job.

“I did not plan for it. I had to shut down the business, and I started looking for a job. I got one in a factory to help sew,” he said.

He even helped some of his former staff find work in the same factory. “I also got a few of my staff jobs in the factory as myself,” Mr Nwoye said.

Although the lockdown has since been relaxed, and he has reopened his business, Mr Nwoye and other small business owners still endure the impact of the pandemic a year after.

“I now have three staff against the eight I used to have. Schools that once patronised me no longer do since they were also affected,” Mr Nwoye said. “One kg of material that we used to buy N2,000 went up to 2,500, while paint for N700 has gone up to N1,000.”

Twenty-six-year-old Collins Orji is another young small business operator in Enugu. He trades both new and second-graded laptops and accessories. COVID-19 started rattling Nigeria just a month after starting his business in February 2020.

Mr Orji was a laptop repairer for more than three years before becoming a dealer. He told The Gazette he decided to take his business online, at the peak of the pandemic in Nigeria, defying the lockdown.

He took advantage of the price increase based on scarcity to sell off his goods and buy more laptops. Selling off an already stocked inventory may have been easy, but it was not enough for Mr Orji to purchase the number of laptops needed to stay in business.

“Some people were calling us to buy laptops. Our goods finished at some point, and we had to look for where to get laptops,” Mr Orji said.

He said he sold some HP laptops double the amount they were bought in early 2020 when he started the business, noting: “The laptop we usually bought N70,000 to N80,000 went up to N150,000.”

Although Nigeria’s central bank had on several occasions released funds for small businesses affected by COVID-19, Mr Orji could not access them since his company was unregistered.

“I do not have much information about the COVID-19 funds given by the federal government, but the only information I got was that I needed to have registered my business with the CAC.

“And, by then, during the COVID-19, I couldn’t register my business with CAC, and my account had an issue with the bank,” he said.

Government support

Nigeria’s government had announced several intervention funds for Micro Small and Medium Enterprises (MSMEs), manufacturers, households, among others affected by the COVID-19.

In early March 2021, the government bank announced additional support of N50 billion for affected MSMEs.

The Gazette learnt the funds were to be disbursed by NIRSAL Microfinance Bank, minority-owned by CBN’s Nigerian Incentive-based Risk Sharing System for Agricultural Lending (NIRSAL). Each retains a loan carrying an annual interest rate of 9 per cent, with a term of up to one year.

While some MSMEs in Enugu told The Gazette that they are yet to receive the fund despite multiple applications, others said they had no sufficient information to process the application.

Mr Nwoye said, like many other Nigerians, he never had adequate information to pursue the online application.

Abiodun Ihebuzor, the chairman of Abuja-based Nigeria Association of Small and Medium Enterprises, estimated about 14,600 people, including 250 SMEs, had received the funds.

“It is a timely intervention looking at the effects of COVID-19 on SMEs. It has provided high-level succour. This facility comes to small business owners at less than 9 per cent, precisely 5 per cent. When you add up other charges in terms of processing and management fee, it still sits at below one digit of 9 per cent,” African News quoted Mr Ihebuzor to have said.

Lingering sufferings despite applying for FG/CBN support

The Gazette findings reveal that young business owners are also not the only people suffering from the impact of the pandemic.

Chizoba Obiageli, 50, a local rice supplier, said despite applying twice to get the COVID-19 intervention funds, none of her applications scaled through.

“I went for training with CBN and NISRAL. I also filled and submitted all the requirements online, but I did not get any funds,” she said.

Narrating the impact of the pandemic on her business, Ms Obiageli said: “When our goods finished, we could not travel out of Enugu to Abakilaki to buy rice. And, after the federal government eased the lockdown, the prices of rice went double the amount we sell.”

Before the pandemic, Ms Obiageli said she sold at least 20 bags of 50KG rice monthly. However, with the pandemic, what she sold could not purchase up to 20 bags of her initial budget.

“I could not pay my workers. I had to reduce their salaries because my customers, who are hotels, event organisers, stopped patronising me due to the pandemic,” Ms Obiagheli told The Gazette by telephone.

Enugu-based graphic designer, Foster Aniude, was also affected by the pandemic. He said many of his customers stopped patronising him because of the high cost of materials used to design, resulting in his increment in charges.

In his early 40s, Mr Aniude had applied for the CBN COVID-19 intervention fund but never got it. He told The Gazette though he was not given, “two of my staff who applied with me got the funds. They gave them N30,000 each,” he said.

Enugu-based tiles dealer Ossai Chidera Cyril, 31, lamented that the COVID-19 badly affected his business, recalling his tile business was affordable since 2017 he started until COVID-19 struck.

Mr Chidera told The Gazette that since the pandemic, tile producing companies increased the price every month.

“Everything became expensive in the peak of COVID-19. Most of the companies are owned by the Chinese and increased the price of tiles by N100 every other month.

“For example, a square meter of wall tiles now costs between N1,700 to N1,800. While transportation that used to be N120,000 has now gone up to N390,000,” he added.

Mr Chidera pointed out that before the pandemic, tile dealers had the liberty to choose the design from the manufacturing companies and see paid goods arrive within 24 hours of purchase.

“Since COVID-19, companies started lacking raw materials and became selective about the designs they make, which means they load whatever they have available, and you have no choice but to take it.

“Before COVID-19, you could pay for goods on Monday and offload on Tuesday or Wednesday. These days it takes two weeks to two months before you see the goods you paid for,” he said.

The Gazette learnt that tiles manufacturers also reduced the quality of goods. “The ceramic tiles reduced in weight and durability, and it seems the more we complain, the worse they get,” Mr Chidera said.

He has heard about the federal government and CBN intervention funds for MSMEs, but his application was unsuccessful.

“I kept trying to access the website they provided, but it kept crashing till I gave up,” Mr Chidera said.

In April 2021, The Gazette had reported that the NISRAL boss, amid widespread allegations of corruption, pocketed funds meant for COVID-19, leading the CBN to halt all further disbursements.

The CBN’s suspension of further loans to NIRSAL under its Managing Director/CEO, Aliyu Abdulhameed, was stated in a March 10 correspondence that referenced a meeting held on February 24 where the decision was taken.

The decision was to be rescinded when NISRAL resolved all of its outstanding loans.

The CBN asked NIRSAL to submit monthly reports on its activities, a decision that indicated a retraction of the apex bank’s confidence long enjoyed by the credit risk managers.

The Gazette put a call across to the CBN spokesperson Osita Nwanisobi who claimed he was in a meeting and requested questions be sent via text and WhatsApp.

For days, Mr Nwanisobi initially declined comments on the total amount released by the CBN to reduce the impact of the pandemic on business owners.

The bank also did not reply to comments on statistics of beneficiaries in Enugu, the selection process, and further plans to reach out to business owners who never got the grant/loan despite applying.

But following a reminder from The Gazette, Mr Nwanisobi said: “I thought I had replied to you, but if I have not, reach out to NISRAL to get the details.”

NISRAL Microfinance Bank did not return calls and text messages seeking comments.

Political gimmick

Executive director of Entrepreneurship Initiative for African Youth in Enugu, Emmanuel Acha, said it was on television that one mostly saw the federal government COVID-19 support fund. “When it gets here, the real people who need the fund do not get it,” Mr Acha told The Gazette by telephone.

Mr Acha described data collection as one major problem hindering the disbursement of the funds and urged the government to liaise with civil society organisations in Enugu to reach out to business owners affected by the pandemic.

“The government should partner with CSOs like my organisation, which is into entrepreneurship development, to help give them data of affected people,” the activist said. “Rather than allowing the funds to be in the hands of politicians who will end up fixing names of their supporters instead of focusing on the people affected.”

This story was supported by the I4C hub through BudgIT Foundation.

We have recently deactivated our website's comment provider in favour of other channels of distribution and commentary. We encourage you to join the conversation on our stories via our Facebook, Twitter and other social media pages.

More from Peoples Gazette

Politics

Katsina youths pledge to deliver over 2 million votes to Atiku

“Katsina State is Atiku’s political base because it is his second home.”

World

Tennessee lawmakers pass bill allowing teachers, staff members carry concealed handguns on campus

Staff members must have the approval of school officials without parents and other staff members being notified.

NationWide

African leaders, heads of govts, UN adopt Abuja Declaration on counter-terrorism

They called upon external actors to cease support(s) to terrorist groups on the continent.

Economy

Flutterwave announces Initial Public Offering for broader long-term vision

“We want to be a long-term company in Africa, for Africa.’’

NationWide

Army sensitises social media users to dangers of fake news

Mr Ugbo said that the programme offered an opportunity for the military to cross-fertilise ideas with youths on best ways to use social media.

NationWide

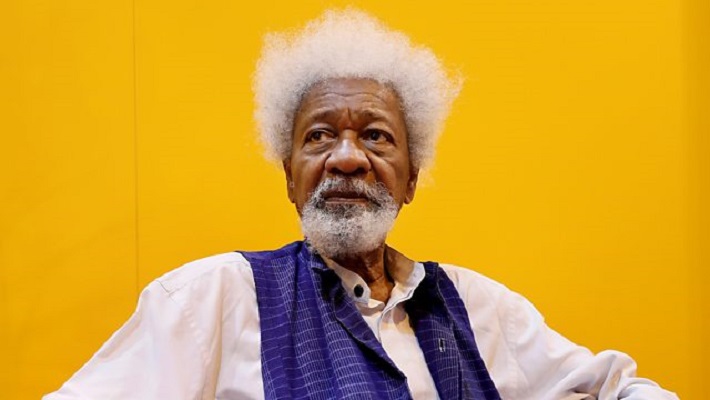

NCC recognises Soyinka as first copyright change champion

The NCC described Mr Soyinka as unarguably the tallest living iroko in Nigeria’s rich literary forest and an advocate for books, reading and copyright.

World

TikTok responds to EU ultimatum on new rewards-for-views app

The commission seeks to know how the Chinese-owned video-sharing platform assessed the addictiveness and the scheme’s mental health risks.