We’ve spent N3.5 trillion on COVID-19 palliatives: CBN

The Central Bank of Nigeria says it has disbursed N3.5 trillion to cushion the effect of COVID-19 pandemic on the country’s economy.

The information is contained in a review of the 132nd communique of the Monetary Policy Committee (MPC) meeting obtained from the apex bank’s website. It was signed by Governor Godwin Emefiele.

Mr. Emefiele said that interventions were largely in the areas of manufacturing, agriculture, electricity and gas, solar power and housing constructions among others.

“Recent interventions are largely in the areas of manufacturing, agriculture, electricity and gas, solar power and housing constructions among others.

“Real sector funds, (N216.87 billion); COVID-19 Targeted Credit Facility (TCF), (N73.69 billion); AGSMEIS, (N54.66 billion); Pharmaceutical and Health Care Support Fund, (N44.47 billion); and Creative Industry Financing Initiative (N2.93 billion).

“Under the Real Sector Funds, a total of 87 projects that included 53 Manufacturing, 21 Agriculture and 13 Services projects were funded.

“In the health care sector, 41 projects which included 16 pharmaceuticals and 25 hospital and health care services are funded. Under the Targeted Credit Facility, 120,074 applicants have received financial support for investment capital.

“The agri-business/small and medium enterprise investment scheme (AGSMEIS) intervention has been extended to a total of 14,638 applicants, while 250 SME businesses, predominantly the youths, have benefited from the creative industry financing initiative,’’ he said.

Mr. Emefiele added that the CBN was also set to contribute over N1.8 trillion of the total sum of N2.30 trillion needed for the federal government’s one-year economic sustainability plan (ESP).

He said that the bank’s policy on loan to deposit ratio also resulted in a significant growth in credit to various sectors from N15.57 trillion to N19.33 trillion between May 2019 and August 2020.

“This growth in credit was mainly to manufacturing (N866.27 billion), consumer credit (N527.65 billion), oil and gas (N477.65 billion), agriculture (N287.11 billion) and construction (N270.97 billion),’’ he said.

(NAN)

We have recently deactivated our website's comment provider in favour of other channels of distribution and commentary. We encourage you to join the conversation on our stories via our Facebook, Twitter and other social media pages.

More from Peoples Gazette

Politics

Katsina youths pledge to deliver over 2 million votes to Atiku

“Katsina State is Atiku’s political base because it is his second home.”

NationWide

CSO urges politicians to embrace genuine opposition, stop carpet crossing

Mr Ezenwa said that opposition political parties were meant to be shadow governments, through policy differentiation.

States

Kogi governor seeks FG’s help to tackle insecurity, flooding

Mr Ododo said the menace of insecurity and flooding in Kogi could impact other states bordering it if left unaddressed.

Showbiz

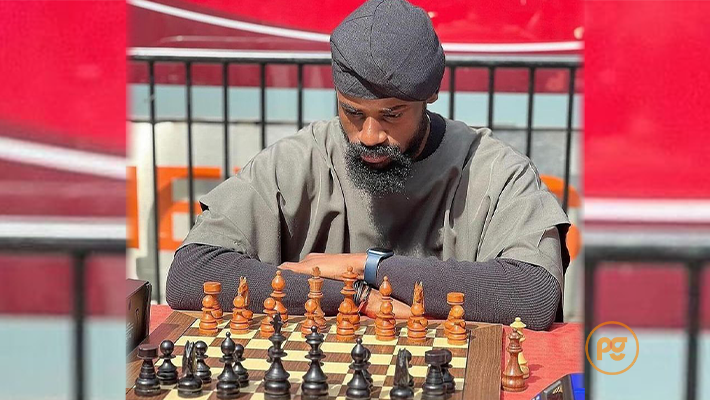

Tinubu hails feat of Nigerian chess master, Tunde Onakoya

The President assured citizens that his administration remained committed to creating and expanding opportunities for the youth.

Politics

Ondo APC accredited voters flee as violence rocks Okitipupa ward

The accredited members scampered for safety as violence broke out.

Lagos

Lagos moves against illegal estate developers in Epe

Mr Olumide said such investors may also risk losing their property or investment to demolition.

States

Ondo APC Primary: Large turnout, security at voting centres in Okitipupa

Mr Ebisanmi said that APC members were ready for the exercise.