Bailout: Gov. Bello lied, documents show how EFCC recovered N19 billion from Kogi Sterling Bank account

Governor Yahaya Bello’s administration opened the controversial fixed account in Sterling Bank where the Economic and Financial Crimes Commission (EFCC) recovered N19.3 billion Kogi salary bailout fund, corporate documents seen by Peoples Gazette have shown.

The fund in the account 0073572696 with the name ‘Kogi State Salary Bail Out Account’ was meant to pay workers’ salaries but allegedly not used for that purpose.

Mr Bello has repeatedly denied the allegation.

The Lagos Division of the Federal High Court, in an order issued on October 15, directed that Sterling Bank return the funds to the Central Bank of Nigeria after the EFCC withdrew its suit on the bailout fund.

“That the management of Sterling Bank has since acknowledged the existence of the said account in their book but claimed same was a mirror account. That it is expedient for the suit to be discontinued and the account unfrozen to enable the transfer and return of the sum to the coffers of the CBN where the said bailout fund was disbursed,” the court order stated.

After the court order, the EFCC, in a letter dated October 21 and directed to the managing director of Sterling, asked the bank to remit the funds and forward proofs of remittance.

“Reference to our letter dated September 21, 2021, and pursuant to an order of the Federal High Court Ikoyi, Lagos State, directing the unfreezing of the above-mentioned account to enable the bank transfer the balance to the CBN, coy of the order is herewith attached for ease of reference,” said Ahmed Ghali, the Lagos zonal commander of the EFCC.

The apex bank also had, on November 9, confirmed the remittance of the fund in a letter to the EFCC chairman, Abdulrasheed Bawa.

“We refer to your letter dated November 5, 2021, and wish to confirm the details of the receipt of the amount as stated below,” the CBN said in the document.

EFCC had also, in a statement by his spokesperson Wilson Uwujaren confirmed that the apex bank had received the N19.3 billion recovered from the Kogi state account.

Mr Bello’s administration had accused Sterling of opening the account without his government’s consent.

Kogi’s Commissioner for Information and Communications, Kingsley Fanwo, while reacting to the EFCC’s statement claimed the fund had been disbursed for its purpose in October 2019.

“There is, therefore, no hidden bailout funds/loan belonging to Kogi that is capable of being returned to the CBN or frozen by an order of court,” Mr Fanwo said over the weekend. “The EFCC knows this, which is why it withdrew the suit it filed in Court on the bailout fund.”

“The Kogi government knows absolutely nothing about the ownership and control of the said N19.3 billion, allegedly returned to the CBN,” he further claimed while challenging the EFCC to provide details of the account.

Mr Fanwo, however, declined The Gazette’s request seeking comments on the corporate documents.

Earlier this month, the Commissioner For Finance, Budget and Economic Planning Idris Asiru had specifically said, “no fixed account was ever opened or authorised by anyone, neither was there any N20 billion kept anywhere,” insisting that the funds were utilised appropriately.

“The facility in that sum collected from the bank via the approval of CBN in 2019 has since been used for the purpose intended. Salary payment and other overheads. Kogi is paying N89 million on a monthly basis to settle the bailout loan,” he had insisted.

EFCC in August made an ex parte application seeking to have the account frozen over allegations that the money was kept in an interest-yielding account with Sterling and was not utilised for its purpose.

The anti-graft agency noted that Mr Bello’s government applied and was granted a credit facility of N20 billion in 2019 for salary payment with an interest of nine per cent for a 240 months tenure. Before that time, the government had opened an account with the name ‘Kogi State Salary Bailout Account’.

The EFCC revealed that “rather than use the intervention funds for the purpose for which it was granted,” Mr Bello’s administration opened a fixed deposit account (No. 0073572696).

“That as at first day of April 2021, the balance standing to the credit of the said fixed deposit account was N19, 333, 333, 333.36. N666,666,666.64 was also said to have been deducted from the account but was not used for the main purpose,” it stated.

We have recently deactivated our website's comment provider in favour of other channels of distribution and commentary. We encourage you to join the conversation on our stories via our Facebook, Twitter and other social media pages.

More from Peoples Gazette

Politics

Katsina youths pledge to deliver over 2 million votes to Atiku

“Katsina State is Atiku’s political base because it is his second home.”

World

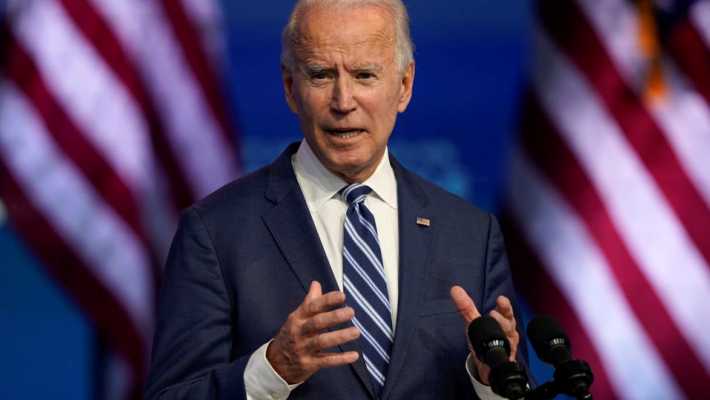

Biden says U.S. will begin sending weapons to Ukraine

“We stand resolutely for democracy and freedom, and against tyranny and oppression.’’

Africa

Nigeria, other African nations’ debt servicing rise from $17 billion to $74 billion

The African Development Bank said the continent’s $824 billion debt burden and opaque resource-backed loans hindered its potential.

World

British Prime Minister Sunak makes first official visit to Germany

Britain and Germany are Ukraine’s most important European arms suppliers.

World

Germany plans to resume cooperation with UNRWA

The October 7 attack by Hamas left some 1,200 people dead in Israel.

Health

WHO targets vaccination for girls against Human Papillomavirus May 27

Mr Toyosi said the vaccination was to protect the girls against cervical cancer.

Health

Cross River targets 886,292 schoolchildren for deworming

Ms Mark said that infection could cause anaemia, malnourishment and impaired mental and physical development.